COVID-19 has disrupted the lives of many and is having significant impacts on businesses. Although it seems that the ‘curve’ may be flattening, there’s still no predictable end in sight. The uncertainty of the virus has led to unemployment being at an all-time high with service-based industries such as hospitality, food and beverage, and retail being forced to shut their doors to the public. Now, with the economy on the brink of a recession and businesses ceasing operations, the most pressing question seems to be, how can business owners navigate this crisis?

It is no secret – being a business owner was already no easy task. CEO’s are faced with challenges every day. The list of day-to-day tasks is endless, from paying salaries, rent, utilities, taxes and NIB contributions, to fulfilling orders, balancing accounts, inventory, marketing, and ensuring customer satisfaction – all in an effort to increase profit and stay relevant in today’s technological era. However, these are unprecedented times and the challenges now seem insurmountable. This is new territory for everyone.

The silver lining is that we are no strangers to facing crises and we will get through this. Here are four strategies small business owners can adopt to help navigate this environment.

Plan for decreased productivity

Many companies are having to decide how to allocate their limited resources and have made decisions to lay off employees, reduce work hours and /or place workers on furlough because of little to no business.

Companies that keep its current workforce must prepare for decreased productivity even if the virus has not affected them directly. Employees could be faced with relatives that require sick aid and take time off. This will affect business performance, whether one or ten employees are forced to take time off. Depending on the nature of the business, encouraging continued work-from-home alternatives is a safe bet to safeguard your staff and their families.

Apply for government and financial assistance to offset slowing sales

Apply for government and financial assistance to offset slowing sales.

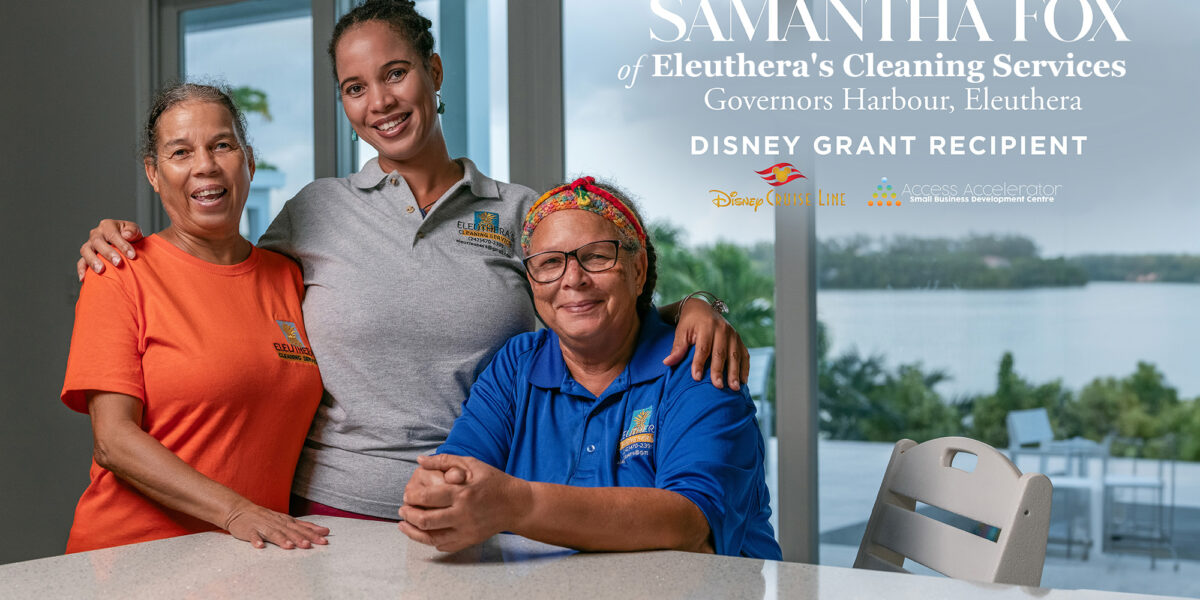

During the beginning of the COVID pandemic, the Government of The Bahamas and financial institutions implemented various assistance programs designed to ease the burden of an economic downturn. Organizations like the Access Accelerator, which has been instrumental in helping and jump-starting hundreds of small businesses through grants and loans, is also available to help Bahamian entrepreneurs navigate through difficult circumstances.

Local banks are offering support by temporarily relieving loan payments, increasing working lines of credit to cover payments, and no loan fees for additional working capital to businesses impacted by COVID-19. The National Insurance Board (NIB) is allowing companies to file for temporary unemployment on behalf of their employees. The Bahamas Chamber of Commerce (BCCEC) is offering its members help with relief packages for small business owners on how to navigate the current environment. If you predict your business will suffer as a result of this pandemic, a low-interest loan or grant might present the best relief for dwindling sales. Take advantage of these loans and grants, if only as a backup in case your cashflow unexpectedly runs low.

Convert to an online platform

A decade ago, having a functional website was a luxury. Today, it is a necessity. Customers can sit down anywhere in the world, on a beach, for example, order a product and have it delivered in days. You can order dinner from your favourite restaurant and have it delivered in your pajamas and without having to go into your wallet. ‘Mom and pop’ establishments must use POS systems and implement marketing strategies in order to compete.

Now is the time to convert your business, whether brick and mortar or pop-up, to an online-based operation. You do not need to be a programmer to create an effective website. There are tons of plug-and-play options for the non-tech savvy person to create an online store. Options include WordPress templates and websites like Wix.com that are designed to make the transition easy and painless. More importantly, these options are cost-effective.

Free assets, such as Instagram and Facebook, are equally as effective in promoting a special or product, as it is to communicate with family and friends. In fact, many companies have relied solely on these platforms to build enterprises without having to pay rent or lease office space.

You can still offer your services even though you are not open to the public. Target your customers, send out e-blasts, newsletters, or WhatsApp messages to inform them of your transition and let this crisis bring you into the new ‘business as usual’.

Be Innovative

A little innovation can go a long way. Companies that can operate without opening to the public may want to think about delivering goods or providing effective signage to inform customers to wait in their cars while their products or goods are being prepared. Utilizing a ticket system while customers wait is an effective way to ensure social distancing while adhering to the COVID-19 emergency orders. Most products and services are a necessity, but procrastination can cause customers to forget or delay orders. Use this opportunity to not only show the customer that you care but to also cement customer loyalty by offering safe and convenient ordering options.

Take this time to give your customers more value. Create combo deals or monthly subscriptions. This will help customers view your offering as a saving rather than an expense. Innovative pricing is also an excellent way to mitigate lower revenues. Payment plans over 4 payments, as opposed to a 2-part payment plan, can relieve the burden on customers.

Nobody knows how long the COVID-19 will impact our economy. One thing is for sure, life has and will change from it. Now is the time to adapt, pivot and creatively think of new ways to make money. The key is survival. The economy always bounces back, so do everything in your power to ensure that your company can withstand this downturn.